– Some staking opportunities can earn investors over 100% APY.

– Staking cryptocurrencies is a passive income opportunity suitable for most investors.

What Is Staking

Staking, in simplified terms, is similar to dividend paying stocks because it offers cryptocurrency owners an opportunity to earn income for buying and holding crypto. But, as with many things in the technology space, staking crypto, or digital assets, on a blockchain can be complicated depending on how deep you dive into it. This is why it’s wise to let a professional, such as a crypto fund, manage your investments.

Why and How to Invest in Staking

Nowadays, many investors prefer staking over traditional investments like a dividend paying stock, Certificate of Deposit (CDs) or a high-yield savings account because of the higher return. For instance, dividend paying stocks often earn investors around 4% APY while CDs and high-yield savings accounts around 2%-4%, but staking can earn investors anywhere from 1% to over 100% APY depending on the rewards offered by the proof-of-stake (PoS) blockchain.

Staking cryptos such as Binance Coin (BNB), Cosmos (ATOM), Cardano (ADA), Polkadot (DOT), Avalanche (AVAX), Solana (SOL), and others, can earn investors a good APY and also appreciate in value. However, these cryptos are open to the volatility of the market so they could potentially decrease in value.

Decentralized finance, or DeFi, is a sector in the crypto space consisting of many different blockchains that offer services similar to traditional finance. Some of these blockchains incentivize early investors by offering high APYs for staking. Sometimes the APYs can even be north of 1,000%. However, many of these blockchains and their corresponding wallets require a unique skill set to use. Crypto hedge funds like Kingsly Digital Asset Fund can provide investors with experience and exposure to DeFi while minimizing risks.

Staking a stablecoin like USDC, which is pegged to the U.S. Dollar, can earn investors up to 9% APY with fintech or staking-as-a-service (Saas) businesses. That’s $80,000 earned in passive income from a $1 million investment!

We use Yield.app to get over 9% APY for staking our stablecoins. One major reason we have an account with Yield.app is because they’re licensed by the Estonia Financial Intelligence Unit (FIU), which provides an added layer of assurance for us.

Keep in mind that with a bigger reward comes a bigger risk. For instance, cryptocurrency accounts and wallets are not FDIC insured like U.S. dollars held in a high-yield savings account at a neobank or digital bank.

Where to Stake Crypto

There are multiple ways to stake crypto:

– Crypto exchange: You can buy crypto and stake it at U.S. crypto exchanges like Gemini, Binance, Coinbase, eToro, Kraken or Crypto.com.

– Crypto fund: You can invest your money with a registered investment advisor (RIA) like Kingsly Capital that manages a crypto fund with a staking strategy.

How to Stake Crypto

There are easy and challenging ways to stake crypto. We ranked these staking options with the first being the easiest and the last the hardest:

– Crypto fund: You can invest your money with a crypto fund that offers a staking strategy. The fund manages everything for you.

– Crypto exchange: You can use a crypto exchange. You will have to manage the buying, holding, staking, selling and tax reporting.

– Web3 & DeFi: You can use a web3 wallet and DeFi protocols. You will have to manage the buying, holding, staking, selling and tax reporting. Furthermore, this involves using and transacting on different blockchains and crypto wallets. (This method should only be used by experts as it requires in-depth knowledge of web3 and DeFi.)

Best Coins for Staking

Some good crypto coins for staking are Binance Coin (BNB), Cosmos (ATOM), Cardano (ADA), Polkadot (DOT), Avalanche (AVAX) and Solana (SOL). Some of these are ecosystems of blockchains that offer good APYs.

Taxed for Staking

The Internal Revenue Service (IRS) has provided little insight about how cryptocurrency staking is taxed, so, at this time, Certified Public Accountants (CPAs) advise that you report revenue from staking as ordinary income.

Proof of Stake vs Proof of Work

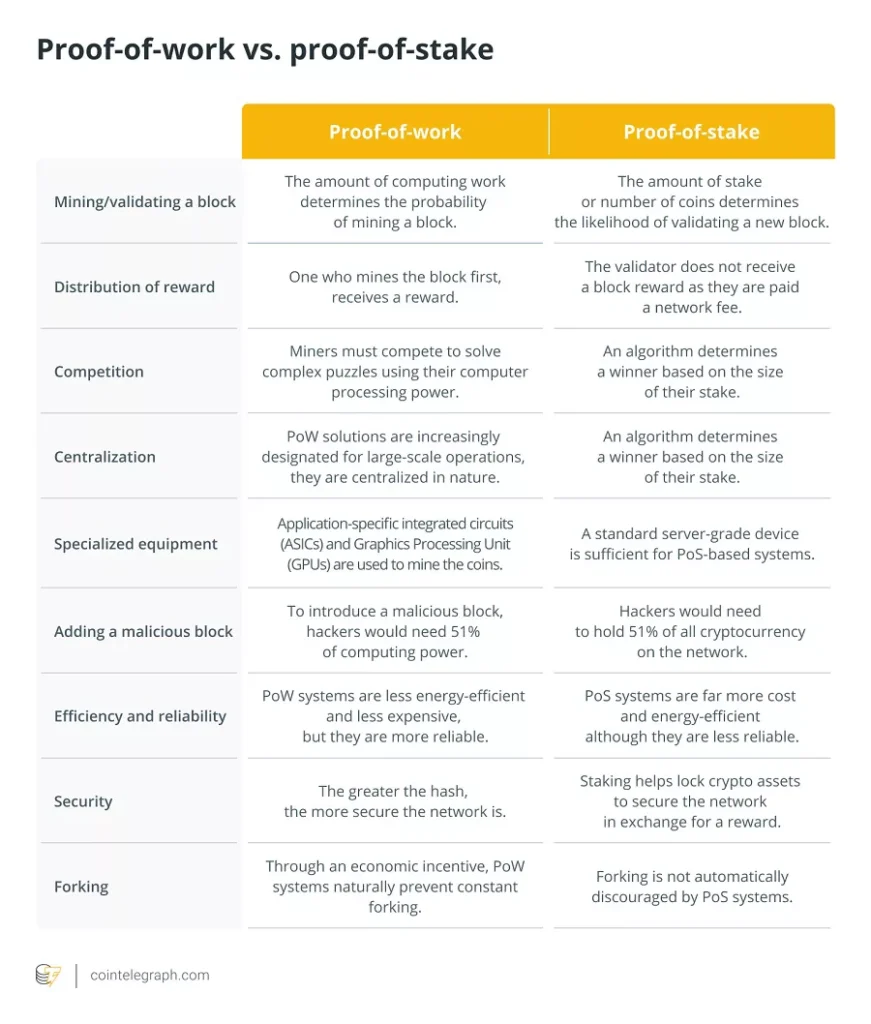

Nowadays, most blockchains are Proof of Stake (PoS), but some, like Bitcoin (BTC), are still Proof of Work (PoW). These chains don’t offer staking. PoS chains use validators as a consensus mechanism instead of “miners,” like on PoW chains. Validator nodes verify authenticity and approve blocks on the chain, and they are rewarded with payments for their good work, while validators acting maliciously get penalized. With PoW, miners use computing power to compete to validate blocks, which leads to heavy energy consumption. This is why developers have started building PoS blockchains instead of PoW.

In 2022, Ethereum (ETH), the second biggest crypto by market cap, forked from PoW to PoS. This was referred to as “The Merge.” ETH’s staking rewards typically range from 3%-7% APY.

Getting Started with Digital Investing

Retire Early with Digital Investing (REDI)

What Is Digital Investing?

This article may be republished online or in print under Creative Commons license CC BY 4.0; Proper attribution and link to our web site are required. View details.

RSS feed

Image by pch.vector on Freepik

The REDI Financial Movement

Retire Early with Digital Investing, or REDI, is a financial movement created by Profit Spotters to attain financial freedom and early retirement via digital investing. Digital investing is the process of using… continue reading

What Are Digital Assets?

Overview:- The term "digital assets” is typically used in reference to blockchain technologies and assets like cryptocurrencies, tokens, staking, perpetual contracts and smart contracts. What Is a Digital Asset? A digital asset is a type of virtual property or...

Investing in Digital Asset Management Funds

Overview:- Digital asset funds typically outperform traditional investments like the S&P 500 and Dow Jones and can be a great investment option for family offices, institutions and accredited investors.Digital Asset Fund Investments Investing...

How to Start Digital Investing

Where to Start Digital Investing Digital investing is the process of using digital technologies to invest in digital assets. Digital investing provides investment opportunities—such as cryptocurrencies, tokens, staking, validator nodes,...

Social Media

Profit Spotters is a digital investing research firm, financial blog, and the creator of the REDI financial movement (Retire Early with Digital Investing). Content on this site is for general informational, educational or entertainment purposes. We do not offer financial or legal advice. Opinions are ours. Images by Freepik and Iconscout. Some links on this site are advertiser or affiliate links that help us earn a commission and operate the site free of charge for visitor like you. By using this site or subscribing to our newsletter you agree to our Terms.