What Is REDI?

Retire Early with Digital Investing, or REDI (red-ē), is a financial movement created by Profit Spotters to attain financial freedom and early retirement via digital investing.

What Is Digital Investing?

Digital investing is the process of using digital technologies to invest in digital assets.

What Are Digital Assets?

Digital assets are items of value that can be bought, sold and stored digitally. The term “digital asset” is most commonly used in reference to blockchain-based investments and assets like cryptocurrencies, tokens (governance, NFT, security, synthetic and utility), staking, liquidity providing, perpetual contracts, smart contracts, among others. However, digital audio, videos, books, websites, apps, data, and the like are also digital assets.

Some assets, like stocks and fiat money, are evolving into digital assets since they are more commonly transacted and stored digitally than physically.

Why REDI?

The world economy is swiftly becoming digital. New digital technologies are producing innovative businesses and investments that are leaving traditional finance in the dust.

Digital investing provides numerous unique investment opportunities—such as crypto trading, staking, validating, liquidity providing, and more—that traditional investing doesn’t offer and that are more convenient and advantageous due to lower fees, higher yields, and higher potential for appreciation. Furthermore, there are fewer barriers to entry with digital investing versus traditional investing.

REDI focuses on using digital investing to generate profits via active and passive income streams and capital gains. Additionally, REDI is flexible and inclusive—the pace, effort and capital applied to digital investing is self-directed and adjustable according to one’s current and desired financial circumstances.

The technological advancements and increasing worldwide adoption for digital assets has created a new economy known as the digital economy. The latest advancement in digital technology, known as blockchain, is more secure and efficient than current computer technology due to its underlying cryptographic technology.

Businesses worldwide are quickly adopting blockchain technology and causing a new tech boom not seen since the 90’s dot-com boom, which is known for the mass adoption of technologies such as email, instant messaging, websites, e-commerce and streaming.

The REDI Lifestyle

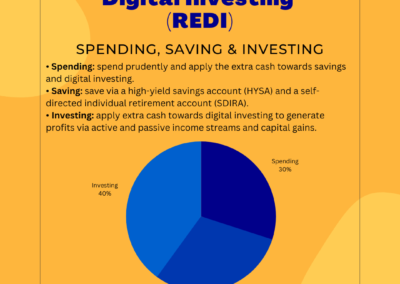

Financial habits used by millionaires to attain financial freedom and early retirement via digital investing:

• Spending: spend prudently and apply the extra cash towards savings and digital investing.

• Saving: save via a high-yield savings account (HYSA) and a self-directed individual retirement account (SDIRA).

• Investing: apply extra cash towards digital investing to generate profits via active and passive income streams and capital gains.

Are you ready to Retire Early with Digital Investing?

Getting Started with Digital Investing

What Is Digital Investing?

What Are Digital Assets?

How to Start Digital Investing

#REDIMovement

Image: Yusuf Bengali, IconScout

What Are Digital Assets?

Overview:- The term "digital assets” is typically used in reference to blockchain technologies and assets like cryptocurrencies, tokens, staking, perpetual contracts and smart contracts. What Is a Digital Asset? A digital asset is a type of virtual property or...

Investing in Digital Asset Management Funds

Overview:- Digital asset funds typically outperform traditional investments like the S&P 500 and Dow Jones and can be a great investment option for family offices, institutions and accredited investors.Digital Asset Fund Investments Investing...

How to Start Digital Investing

Where to Start Digital Investing Digital investing is the process of using digital technologies to invest in digital assets. Digital investing provides investment opportunities—such as cryptocurrencies, tokens, staking, validator nodes,...

Social Media

Profit Spotters is a digital investing research firm, financial blog, and the creator of the REDI financial movement (Retire Early with Digital Investing). Content on this site is for general informational, educational or entertainment purposes. We do not offer financial or legal advice. Opinions are ours. Images by Freepik and Iconscout. Some links on this site are advertiser or affiliate links that help us earn a commission and operate the site free of charge for visitor like you. By using this site or subscribing to our newsletter you agree to our Terms.